2025 Top Manufacturers | Progress and Pressure

Window and door manufacturers report broad-based growth in sales, production and innovation—while navigating tariffs, labor shortages and economic uncertainty

Photo courtesy of ProVia

This year’s Top Manufacturers Report reflects, in a word, growth. Growth in sales. Growth in production. Growth in business and product development.

Even so, plenty of unknowns and challenges test the industry. As of this writing, U.S. President Donald Trump’s administration has implemented tariffs on dozens of countries, including a 104% levy on Chinese goods. China has responded with a retaliatory tariff of 84% on U.S. goods.

Concerning though these tariffs are to many in the fenestration industry, several respondents noted everyone is in the same boat and all are navigating it together.

This year’s Top Manufacturers Report gives an overview of the new construction and remodeling and repair markets, plus the state of the larger manufacturing industry, before diving into findings from the Top Manufacturers survey, which collected responses in March 2025. The report is bolstered by data from John Burns Research and Consulting’s quarterly Window & Door Market Survey, the result of an exclusive partnership between Window + Door and JBREC.

The 2025 Top Manufacturers Report

- The Big Picture

New home construction, remodeling and manufacturing outlooks - The Residential Fenestration Market

Market conditions, sales, product trends, labor, automation, looking ahead - The Top Manufacturers List

North America’s largest manufacturers of residential windows, doors, skylights and related products, based on sales volume

Photo courtesy of Miter

The Big Picture

New construction

Last year ended with single-family growth in all geographic regions, according to the National Association of Home Builders Home Building Geography Index. “Single-family housing construction ended the year with growth as a shortage of existing homes for sale continues to increase demand for newly built homes,” says NAHB Chairman Buddy Hughes.

“Single-family construction has been holding remarkably steady, despite elevated mortgage rates and tight lending standards for construction and development loans,” says NAHB Chief Economist Robert Dietz. “Upside and downside risks will become clearer as the new year progresses. An easing regulatory environment and tax cuts could act as tailwinds, but tariffs and potentially higher deficits could dampen market momentum. Additionally, a growing trend away from work-from-home could increase building activity in inner suburbs in the quarters ahead.”

New home sales increased 1.8% in February and are up 5.1% compared to a year earlier, according to data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The organizations also report that overall housing starts increased 11.2% in February to a seasonally adjusted rate of 1.5 million units.

“Lower mortgage rates helped to lift demand in February, despite other near-term risks such as tariff issues and affordability concerns,” says Dietz. “While new home inventory is at an otherwise elevated 8.9 months’ supply, total home supply—new and existing—is a relatively lean 4.2 months’ supply for February.”

Builders continue to express concern. “While solid demand and a lack of existing inventory provided a boost to single-family production in February, our latest builder survey shows that builders remain concerned about challenging housing affordability conditions, most notably elevated financing and construction costs as well as tariffs on key building materials,” says Hughes.

R&R

Annual expenditures for improvements and maintenance to owner-occupied homes are expected to grow modestly through 2026, according to the latest Leading Indicator of Remodeling Activity from Harvard University’s Joint Center for Housing Studies. Year-over-year spending for home renovation and repair will increase a projected 2.5% to reach a record $526 billion by the first quarter of 2026.

The report indicates high home values and other strong economic indicators have supported an uptick in homeowner improvement spending, but cautions economic volatility around tariffs and falling consumer confidence could dampen this expected growth.

Meanwhile, the NAHB/Westlake Royal Remodeling Market Index for the first quarter of 2025 showed a five-point drop in remodeling market sentiment. Although the reading of 63 is in positive territory, it is only the second time since the first quarter of 2020 that the RMI has been this low. Dietz echoes the LIRA’s caution. “The five-point decline in the RMI likely reflects consumer uncertainty, fueled by rising costs and tariff concerns,” he says. “Although almost all the data for the first-quarter RMI were collected before the release of specific reciprocal tariffs, the debate and uncertainty over tariffs has had an effect on consumer confidence. Indeed, remodelers responding to the RMI survey reported that their suppliers have already increased prices by an average of 6.9% since January, due to the anticipated effect of tariffs.”

Manufacturing

The U.S. faces a shortage of 1.9 million manufacturing workers by 2033, according to a study from the Manufacturing Institute and Deloitte. Nearly half of the 3.8 million positions that will open could go unfilled. The manufacturing industry averages about 500,000 open jobs through the past 12 months, making it a systemic challenge rather than a short-term trend, says Carolyn Lee, president and executive director, Manufacturing Institute, in the State of the Manufacturing Workforce Address in February. Retirement and manufacturing growth contribute to these shortages.

“We have to inspire more Americans to see themselves in manufacturing,” Lee says. “That starts early, with programs that spark curiosity and excitement for careers in our industry. And when I say early, I mean as young as nine or 10 years old—because today’s fourth graders will graduate in 2033 and may be our future team members.”

The National Association of Manufacturers Q1 2025 Manufacturers’ Outlook Survey revealed 76.2% of participants cite trade uncertainties as the foremost challenge. This is a 20-percentage point increase from the prior quarter and 40 percentage points from the third quarter of last year. Increased raw material costs were the second-most cited challenge (62.3%).

The survey also says that if Congress fails to act now on extending the Tax Cuts and Jobs Act, 69.35% of survey respondents will delay purchasing capital equipment. Additionally, 45.23% would hold off on hiring, 44.72% would stall expansion of operations, 41.71% would limit R&D investments, and 40.20% would curb increases in employee wages or benefits.

Top Manufacturers

All charts and graphs are sourced from the Window + Door Top Manufacturers Report unless otherwise noted.

Meet the Respondents

Respondents to this year’s Top Manufacturers survey had about equal parts national versus regional companies, with a small percentage serving Canada only. The highest number of respondents posted sales in the $100-$200 million range, but participants ranged from upwards of $1 billion in sales to less than $15 million, ensuring the survey data represents small, medium and large manufacturers.

74%

Report higher gross sales in 2024 compared to 2023.

90%

Experienced “measurable, significant” growth over the past five years.

78%

Added production capacity in 2024.

Sales, Growth and Production

Most survey respondents indicated growth in nearly every area the survey queried about. The Window & Door Market Survey, in partnership with John Burns Research and Consulting, substantiates this. Over half (55%) of window and door companies reported volumes growing in fourth-quarter 2024 with average volumes across all companies growing 2.2% year over year. Revenue likewise increased, with an average year-over-year growth of 3.7%.

Many companies have expanded into new geographic areas and have plans to continue that growth. Several also referenced facility additions and expansions to increase production and add product lines. Marvin, for example, is investing in a 400,000-square-foot manufacturing facility in Kansas City, slated for completion this year. It also opened two new distribution centers in the past year.

“We are in the process of expanding our manufacturing facility in 2025 to add innovative aluminum storage solutions and improved aluminum fabrication equipment,” says Sarah Harper, president, All Weather Architectural Aluminum. “These investments are a predecessor to launching a whole new line of minimalist, modern windows and doors.”

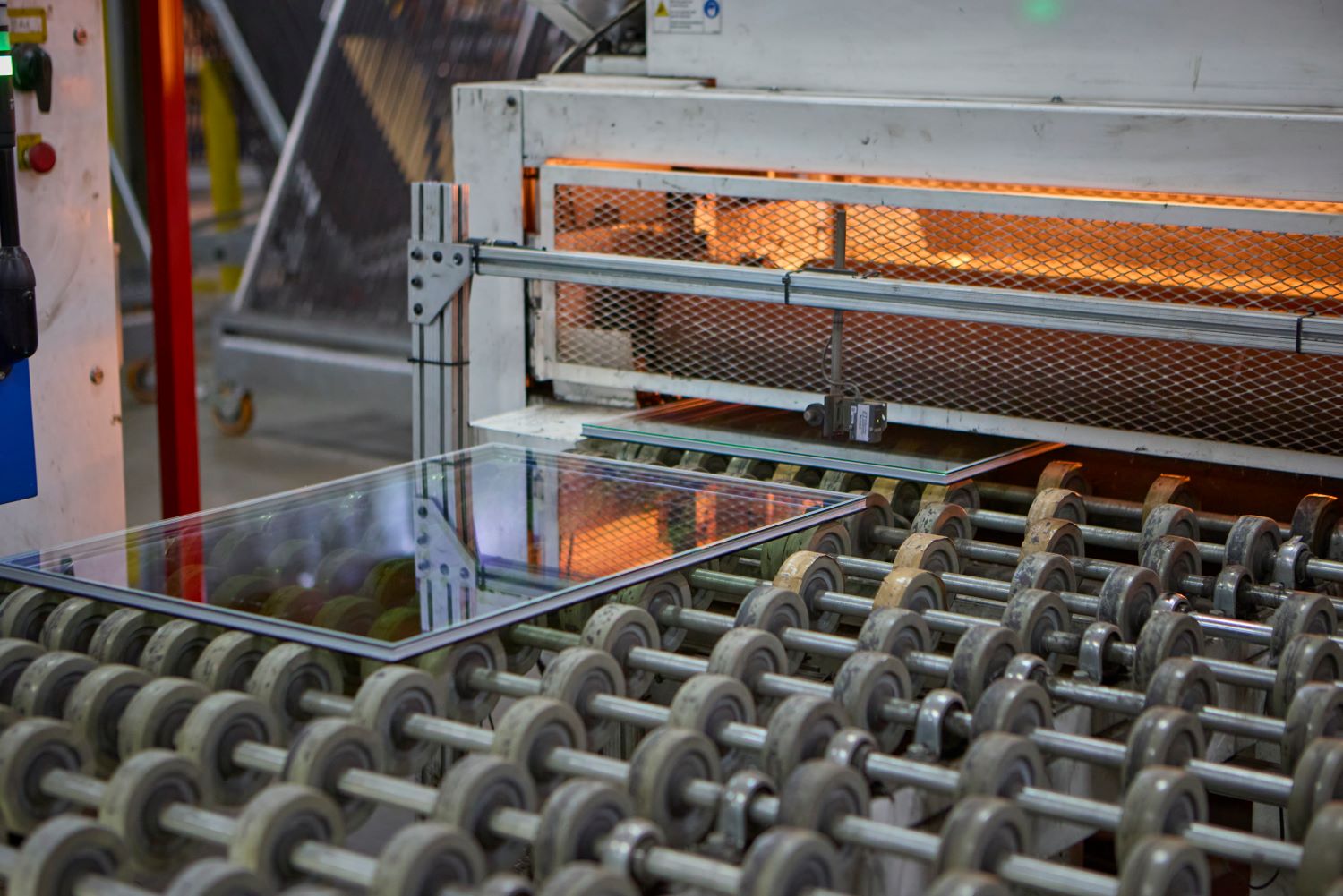

More companies each year indicate they are bringing more glass operations in house. Yet others have explored new markets, such as multifamily, commercial or focusing on new construction or replacement markets.

“ProVia has dramatically grown in every area over the past five years. We have more than doubled our employee count, built new facilities, bought and renovated other facilities, acquired a lamination company, and increased market share,” says Joe Klink, executive director of corporate engagement, ProVia.

Despite the labor concerns in the industry, many survey respondents cite hiring more people to keep up with the growth and product demand.

“We have grown from 400 to 700 employees and expanded into glass tempering through GlassBuilt Manufacturing,” shares Durabuilt Windows & Doors. “Our revenues have doubled, with consistent year-over-year growth of 18% to 24%. We have increased market share across all regions and successfully expanded into British Columbia. Innovation continues to drive our success with the introduction of new product lines. Beyond products, we have made significant advancements in supply chain efficiency, automation, IT infrastructure and operational systems, reinforcing our ability to scale.”

One respondent that serves the U.S. and Canada has grown through strategic expansion and innovation, as well as a shareholder transition that enabled the company to invest $8 million in automation and restructuring into business units. “Our focus on innovation—26% of current sales come from products developed in the past four years—has helped us gain market share and sustain long-term growth,” shares the company.

Production growth is also high on companies’ minds. Responses for what drives production growth vary from “everything,” or, “nearly every business factor,” to specific product materials and processes, such as aluminum, co-extrusion and insulating glass units, to specific business goals like product quality and safer processes.

“We are focused on enhancing several key areas of production, including the addition of a new glass line and upgrading our welding capabilities with new welders and weld cleaners,” says Aron Perelman, vice president marketing and sales, Climate Solutions Windows and Doors.

Enhancing production, including automation, also allows companies to shift current employees to areas that require more skill.

Photo courtesy of All Weather

Products

18% of companies have Environmental Product Declarations for products.

Energy efficiency rules much of today’s product development, with over a third of respondents planning to put product development dollars into energy efficiency in 2025 and efficiency being the most-requested product feature from customers. (Larger windows and doors and color are close behind.)

Although most companies do not have Environmental Product Declarations for their products, the 18% that reported they do is up from the 11% of companies that reported having one in Window + Door’s 2025 Industry Pulse survey.

Among those that do not have EPDs, most report they are not important to the end user and creating EPDs is not a priority. “As a small company, we continuously evaluate where to make investments that will have the greatest impact on our customers, colleagues and communities. Unfortunately, the EPD has not made it to the top of priorities in recent years,” wrote one respondent.

Some, however, do note requests for EPDs, with some saying the requests are “frequent” and others saying requests are increasing. Others note it is part of their commitment to environmental responsibility and helps support transparency.

Beyond requests is a sense of responsibility for some companies. “It aligns with our vision to create healthier and safer living environments,” writes manufacturer ES. “At ES, having an EPD reflects our commitment to sustainability and transparency. It allows us to support green building certifications, meet regulatory requirements, and provide our clients with verified data on the environmental impact of our windows and doors—helping us drive responsible innovation and reduce our carbon footprint.”

In addition to sustainability and energy-efficiency considerations, technology continues to infiltrate the product sector in two major categories: hardware and glass.

Automatic sliding doors primarily target the luxury market right now. More and more entry door manufacturers offer entry door locks controlled via smartphones, digital keypads or finger scanners. “We offer automated products because they enhance functionality, comfort and energy efficiency meeting the evolving needs of modern architecture and smart living,” representatives from ES share.

Privacy glass, such as CLiC and Fog are gaining momentum for added customization, security and energy efficiency. “We continue to explore smart home products,” says Dean Ruark, VP of engineering and innovation, MITER Brands. “Within the Florida market, we offer automated lock solutions for select door systems that provide unique keyless and remote entry solutions to drive the multipoint locks required in the impact resistant market. In addition, our iLAB offers privacy glass solutions while also meeting impact-resistant requirements, allowing the homeowner to control privacy, without compromising the benefits of 24/7 protection from hurricanes."

Photo courtesy of Marvin

Labor

6% Growth in direct labor costs year over year. Source: JBREC

Despite labor being an evergreen pain point, manufacturers indicate it’s no harder to find workers than usual. And most plan to hire new employees this year. Challenging though recruitment can be, it is employee retention that tops manufacturers’ labor struggles. A positive company culture and competitive salaries are by far the most effective retention strategies.

On the recruitment side, nearly one-third of companies note referrals are the most effective strategy. Agencies and open interviews come in a distant second and third.

Training is another big component of labor and serves to both attract new talent and retain existing talent. Companies share a range of difficulties around training new employees. Some of it involves employee motivation and reticence to learn new skills. Other challenges revolve around language barriers. Many comments reference the time commitment for training—the time it takes to train a new employee, the struggle to find time among an already stretched-thin workforce and the years it can take to build a true knowledge base for what can be very customized and complex products. “The majority of our manufacturing process are craftsman positions, with hand tools. Learning the materials behaviors and natural tendencies and learning the ‘feeling’ is a talent that goes beyond a standard operating procedure,” shares Tanisha Arellano, chief operating officer, Panoramic Doors.

“Training new employees can be time-consuming, especially if it involves teaching complex processes or systems,” shares Patrys Wild, senior vice president and chief human resources officer, YKK AP North America. “Balancing training with regular work responsibilities can be challenging for both the trainer and the trainee. This applies to both sides of training; managers must dedicate time while still completing their work. The new employee must learn everything with the expectation that they can begin producing in short order, sometimes even before they are completely trained.”

Wild further notes that it can be difficult for new employees to retain large amounts of information, especially as it could be likely new employees lack essential knowledge and experience in fenestration. “Because we participate in a niche industry, we sometimes underestimate the ability for new employees to grasp key concepts quickly,” she says. “Reinforcement and repetition may be necessary to ensure comprehension and retention.”

Cross-training is another critical part of training, which also demands time and a willingness to teach and learn. “This requires new hires to learn and master a wide range of tasks and procedures quickly, while we balance our daily production requirements,” says Perelman.

Automation and Technology

91% currently employ automation in the factory.

Three years ago, 84% of manufacturers used automation. Today, that number has grown further to 91%. Nearly two-thirds anticipate adding automation in the coming year. Welders, cleaners, robotics, tooling, material handling, assembly, packaging and glass fabrication are all on the table for where companies leverage automation.

“It can vary from a simple machine that makes a repetitive process easier to a more complex machine cell that automates multiple processes,” writes MITER Brands. “In short, we’re looking to make the hardest work easier.”

This year’s survey asked manufacturers how they decide to add automation. Return on investment, enhanced employee safety and cost-benefit analyses factor into the decision, but it goes much deeper than that.

Automation and technology should facilitate continuous improvement. ES shares its process: “We evaluate the potential return on investment, considering factors like increased throughput, labor optimization and reduced waste. We also assess how automation will integrate with our existing systems and workforce, ensuring it supports—not disrupts—overall operations.”

Artificial intelligence is another area of growth. While only 36% of respondents use it in their businesses, the figure is growing. Most manufacturers report using it in an office setting. AI helps generate marketing materials and automates meeting minutes and other administrative tasks. It can also help employees craft emails, communications, and respond to service issues and online reviews.

Photo courtesy of Cornerstone Building Brands

Looking Ahead

40% report that housing affordability has not affected their business.

Housing affordability is affecting the industry. While 40% indicate it hasn’t influenced their business, a full quarter are unsure, with the remaining indicating it has. The list of how is extensive. Builders are downsizing their homes to increase affordability. Markets aren’t growing with the economy. High interest rates affect both new construction and R&R. An overall increase in home costs leaves less for people to spend on home improvement costs, plus many consumers are conservative with their incomes during times of uncertainty.

Of note, however, is that the luxury market remains mostly insulated from the effects of housing affordability.

The Window & Door Market Survey showed material costs increased an average of 6% year over year for companies. However, more than two-thirds of respondents report no extended material lead times, allowing for improved cycle times.

Many respondents wrote about concern over what some call the “tariff wars.” They’ve extended the lead times on raw materials and, of course, cost. Some companies seek to renegotiate vendor partnerships and explore other supply chain options.

“The economic climate is decreasing consumers’ confidence, which in turn will translate into potential lower sales,” writes one manufacturer. “This will compound with rising labor and material costs, challenging the overall business profitability.”

Top Manufacturers survey respondents shared several tactics for tackling tariffs:

- Sourcing domestically as much as possible

- Raising prices as needed

- Ensuring secondary and tertiary suppliers

- Maintaining transparency with customers

- Absorbing costs where possible

- Meeting with elected representatives

- Splitting the costs with suppliers

Data from John Burns backs this up. About 73% of companies expect to raise prices in 2025 with an average increase of 3.6%. The same survey revealed an overall optimism for business in 2025: 91% expect full-year 2025 revenue to be the same or higher than in 2024. Of note, however, is the likelihood that revenue increases will be related to price rather than increased volume.

It can be easy to focus on the challenges, but the other side of the same coin is the opportunities the industry looks to leverage. Those opportunities can include growing market share in adjacent geographies, adding products and expanding marketing efforts. One company notes it is recognizing cost efficiencies through doing its own glass. Others are growing into the multifamily market.

The List

The May/June Digital Issue

More details about each of the 2025 Top Manufacturers on the List below are available in the May/June digital issue of Window + Door Magazine.

National unless otherwise indicated

- Andersen Windows & Doors

- Associated Materials

- Bigfoot Door

- Builders FirstSource

- Champion

- Cornerstone Building Brands

- Crystal Window & Door Systems

- EuroLine Windows Inc.

- Everlast Group of Companies

- Fenplast Inc.

- Hope's Windows Inc.

- Inline Fiberglass Ltd.

- Innotech Windows & Doors Inc.

- Jeld-Wen

- Kensington HPP Inc

- Kolbe & Kolbe Millwork Co.

- Kommerling USA

- LePage Millwork

- Loewen Windows and Doors

- Lux Windows and Doors

- Manhattan Steel Door and Window Co.

- Marvin

- Masonite

- MITER Brands

- Novatech

- Peerless Products Inc.

- Pella

- Plastpro

- Sierra Pacific Windows

- Simpson Door Company

- Stanley Doors

- Starline Windows

- Sun Windows and Doors

- Taylor Entrance Systems

- Therma-Tru Doors

- Trimlite LLC

- Trinity Glass International

- Vector Windows

- Velux

- Weather Shield Mfg.

- Westlake Royal Building Products

- Wincore Windows and Doors

- Woodgrain Millwork

- Arcadia Custom

- Alpen High Performance Products

- Climate Solutions Windows & Doors

- Croft LLC

- Earthwise Group LLC

- ES

- Euro-Wall

- FrontLine Bldg. Products Inc.

- GlassCraft Door Co.

- Ikon Windows LLC

- Interstate Window & Door Co.

- Lincoln Windows & Patio Doors

- Lindsay Windows

- NT Window Inc.

- OpenView Products LLC

- Panoramic Doors

- ProVia

- Steves & Sons Inc.

- Thermal Windows LLC

- Quaker Windows & Doors

- Wincore Windows & Doors

- Air Master Windows and Doors

- All Weather Architectural Aluminum

- ATI Windows

- Aurora Doors & Windows

- Castle Windows

- Comfort View Products LLC

- Comfort Windows

- Elevate Windows and Doors

- Gerkin Windows and Doors

- Gilkey Window

- Glass Rite

- Ideal Window

- International Window

- Joyce Manufacturing Co.

- Mathews Brothers Co.

- MGM Industries

- Midway Windows and Doors

- Moss Supply Co.

- Northeast Windows USA Inc.

- Okna Windows Manufacturing

- Polaris Windows and Doors

- Premium Windows & Doors

- Regency Windows Plus

- Seaway Manufacturing Corp.

- Slocomb Windows and Doors Inc.

- Stewart Brannen Millworks

- The Coeur d’Alene Window Co.

- Thompson Creek Window Co.

- United Window & Door

- Upstate Door

- Vinyl Kraft

- Vinylmax Windows

- Viwinco Inc.

- ViWinTech Window & Door Inc.

- Vytex Windows

- Wallside WIndows

- Winchester Industries

- Window Mart

- YKK AP America Inc.