The Bottom Line: Increasing storm severity and coastal population growth are driving demand for impact-resistant windows, particularly in high wind speed zones along the Gulf and Atlantic coasts, with regulations requiring stringent standards for these products to minimize damage from hurricanes, leading to significant market growth opportunities.

With populations increasing in vulnerable coastal counties, demand for weather-resistant building products has increased as the severity of storms and wind speed intensify. Storm activity and population growth are significant considerations as the impact-resistant windows market continues to evolve.

The Florida Building Code and other regulatory bodies classify areas along the Gulf and Atlantic Coasts into wind speed zones. The code requires building envelope products used in higher wind speed zones to comply with stringent design standards to minimize damage to homes from high winds and windborne debris in hurricane-prone areas.

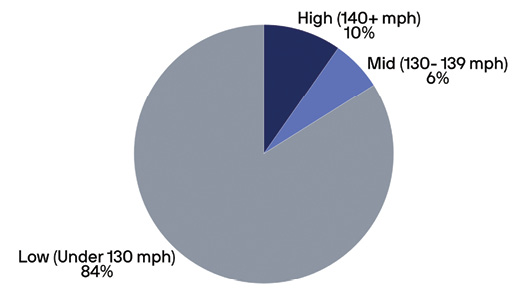

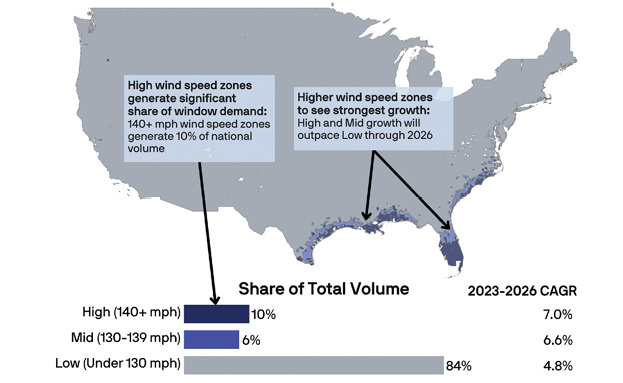

Figure 1 groups window demand into three wind speed tiers (high, mid and low), quantifying the number of units demanded in each tier based on the underlying housing stock and usage metrics. In 2023, nearly 10% of U.S. residential window demand came from the highest wind speed zones (140-plus miles per hour). That’s roughly six million units consumed in the most hurricane-prone areas of the country, primarily along the Gulf Coast and up the Eastern Seaboard.

Escalating intensity is an increasing threat

Storms in the Atlantic Basin have increased and are expected to accelerate and intensify, inflicting more damage and reaching further. The U.S. National Oceanic and Atmospheric Administration projects that hurricanes will likely have 10% higher wind intensities in the coming century and will reach the most intense Category 4 and 5 levels. The “poleward expansion” phenomenon shows hurricanes affecting areas further north and south than they have historically impacted. For example, Hurricane Sandy hit the Northeastern Seaboard in 2012 and was the fifth costliest hurricane on record.

Population growth in coastal counties

There are over eight million dwelling units within one mile of the Gulf Coast, which account for over 6% of the national housing stock of almost 140 million units. For the country overall, the number of dwelling units increased about 1% per year from 2000–2023. Gulf Coast dwellings grew at an annual rate approaching 2%, nearly twice the national average, as more Americans migrated south.

Homeowners in high wind speed zones in Southern states have a heightened need for replacement windows. Principia research shows homeowners are more likely to have replaced their windows for weather-related reasons if they live in a high wind speed zone. Homeowners in the highest wind speed zone were 1.5 times more likely than homeowners in lower wind speed zones to cite weather damage as the reason for replacement. Further, homeowners who replaced their windows for weather-related reasons did so an average of 10 years sooner than homeowners replacing for age-related reasons.

High wind speed zone demand to grow

Window demand growth is projected to be strongest along the hurricane-prone Gulf Coast, including Texas and Florida, and up the East Coast. Window demand from the highest wind speed tier will top seven million units by 2026, growing at a compound annual growth rate of 7%. In comparison, low wind speed zones are expected to see slower growth of 5% annually.

Impact-resistant window segment grows

Ever since Hurricane Andrew devastated South Florida in the 1990s, codes have required windows in high wind speed zones to be impact-resistant. Code authorities require new and replacement windows to be impact-resistant or protected from impact if located within one mile of the coast where the design wind speed is 130 mph or greater, and anywhere the design wind speed is 140 mph or greater.

Impact-resistant windows are an important element of home hardening. Florida encourages home hardening with financing and sales tax incentives. Impact-resistant windows can also reduce home insurance premiums—important in a state with the nation’s highest average home insurance cost.

Many manufacturers are now participating in the impact-resistant window segment to address the 10% of national demand generated by homes in the highest wind speed zones. Among large window manufacturers selling in the southeastern U.S., roughly half now have at least one model rated as impact-resistant. Over time, many major window manufacturers have entered the impact-resistant market by acquiring smaller impact-resistant window manufacturers in Florida and the Southeast.

Projected growth opportunities

Demand for impact-resistant window products in high wind speed zones is projected to grow as migration to the Gulf and Atlantic Coasts continues and storms intensify. Over the next five years, the number of windows consumed by homes in 140-plus mph wind speed zones will represent an opportunity for above-market growth, increasing from six million windows in 2023 to eight million in 2028, and expanding from 10% share of national demand to 11%.