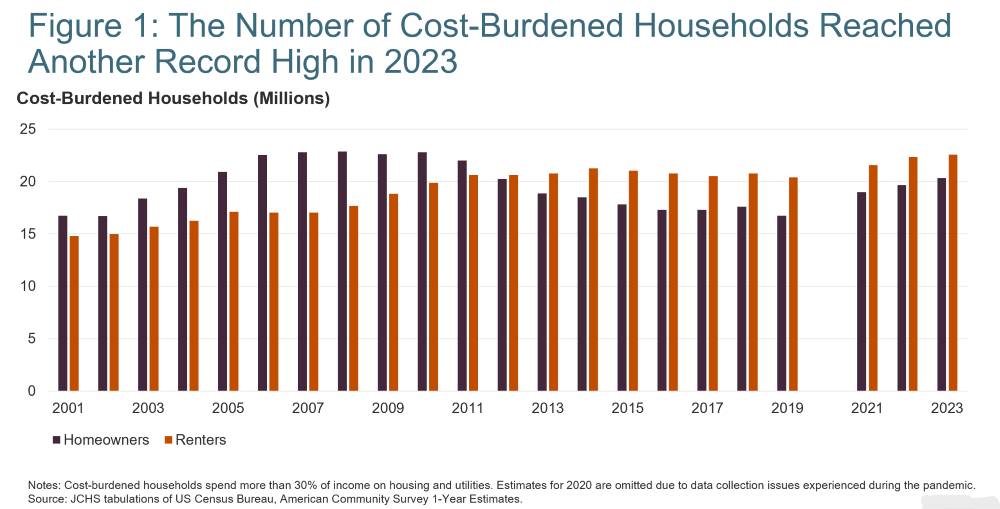

Housing affordability worsened again last year, as a record number of US households were cost burdened. According to tabulations of the newly released 2023 American Community Survey data by the Harvard Joint Center for Housing Studies, an all-time high 42.9 million households were cost burdened, meaning they spent more than 30% of their income on housing costs. Annually, an additional 850,000 households had burdens, continuing a trend of rapidly deteriorating affordability since the start of the pandemic. Additionally, 21.5 million households were severely cost burdened, devoting more than 50% of their income to housing, marking another all-time high.

Key takeaways

- The number of cost-burdened households reached another record high in 2023.

- Cost burdens have risen especially rapidly for lower-income homeowners and middle-income renters.

- Households of color generally face greater affordability challenges than white households.

The majority of the rise in burdened households was driven by an increasing number of cost-burdened homeowners. Indeed, homeowner burdens increased by 650,000 households in 2023, pushing the number of homeowner households with burdens up by 3.6 million since 2019 to 20.3 million overall. Fully 24% of homeowners were burdened by housing costs. While the number of burdened homeowners is still far below the record 22.9 million seen during the Great Recession, last year’s increase indicates a worrying trend. Homeowner cost burdens have risen rapidly as a growing number of older adult households retire or scale back at work—reducing their incomes—and as ongoing housing costs rise. Median monthly costs for homeowners increased 6% in 2023 to $1,327. Overall costs for homeowners have risen 18% since 2019. Meanwhile, payments for homeowners without a mortgage—driven by rising insurance costs and property taxes—have increased an even more striking 28% since before the pandemic. At the same time, median homeowner incomes have risen 16%.