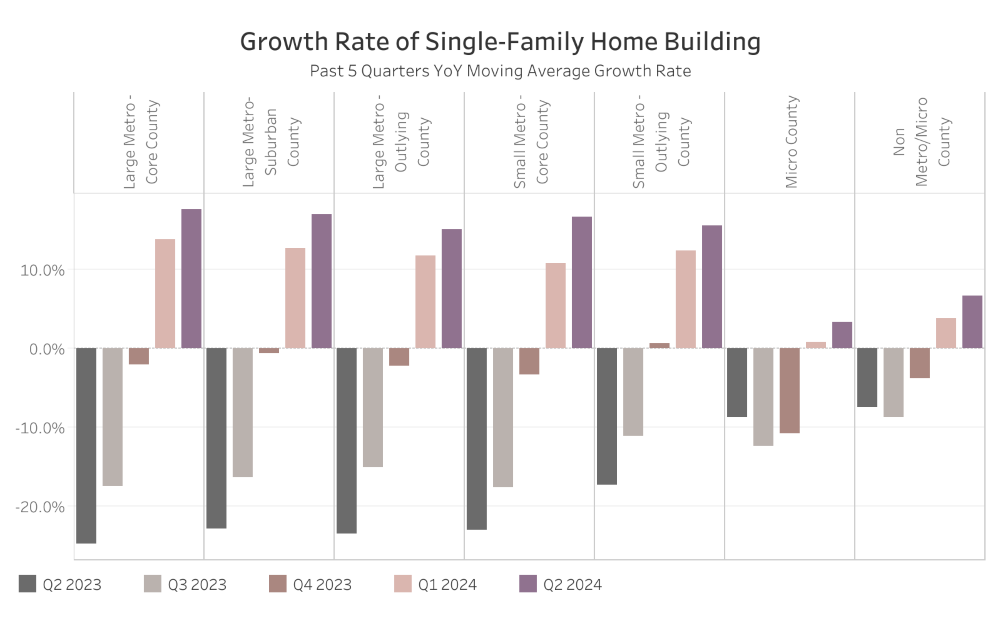

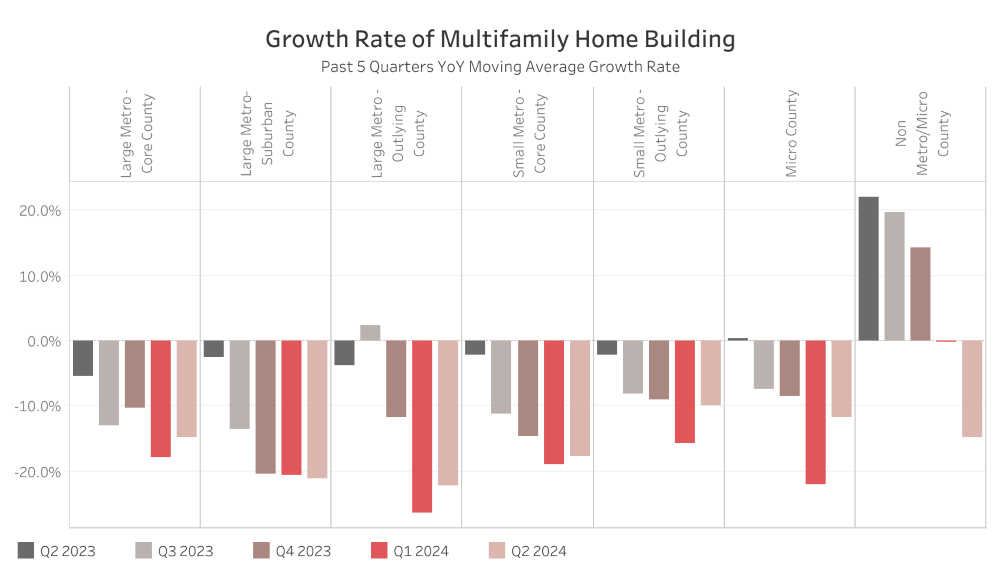

A lack of resale homes and pent-up demand more than offset high mortgage rates and contributed to solid single-family permit growth across nearly all geographic regions in the second quarter. However, multifamily construction permit activity continued its slide downward across the board to start 2024. Meanwhile, single-family and multifamily construction both exhibited strong growth in second home markets over the past decade, according to the latest findings from the National Association of Home Builders Home Building Geography Index for the second quarter of 2024.

Single-family

The single-family permit growth rates for all of the HBGI geographic regions were positive in the second quarter, with five of the seven posting double-digit gains. Large metro core counties had the highest growth rate for the second straight quarter at 17.6%. Micro counties had the smallest growth rate, posting a 3.4% gain.

Large metro core counties are primarily suburban areas, and this high rate of single-family permit activity is an indication that telework is a still a factor and people are moving to more affordable areas.

Breaking down the nation’s seven metro and county areas, the second quarter HBGI shows the following market shares for single-family home building:

- 16.1% in large metro core counties

- 25.0% in large metro suburban counties

- 9.4% in large metro outlying counties

- 28.9% in small metro core counties

- 9.9% in small metro outlying areas

- 6.4% in micro counties

- 4.3% in non-metro/micro counties

Multifamily

All seven HBGI geographic regions posted negative multifamily permit rates in the second quarter because financing remained tight and high levels of construction inventory of just under 900,000 units is limiting the need for new multifamily permits. This weakness is consistent with the NAHB Multifamily Production Index, which had a second quarter reading of just 44, marking a year-over-year decrease of 12 points.

The second quarter HBGI shows the following market shares for multifamily home building:

- 40.1% in large metro core counties

- 25.3% in large metro suburban counties

- 3.5% in large metro outlying counties

- 22.8% in small metro core counties

- 4.1% in small metro outlying areas

- 3.0% in micro counties

- 1.1% in non-metro/micro counties

NAHB's response

“Despite the elevated interest rate environment, single-family construction continues to move along at a better pace than 2023 and has been led by a rebound in construction activity in high density areas,” says NAHB Chairman Carl Harris. “Multifamily construction continues to slow as builders deal with higher rates, a shortage of workers and supply chain concerns for some building materials.”

“The strength in single-family construction at the start of the year continued in higher density areas, matching other data indicating a gain for townhouse construction at the start of 2024,” says NAHB Chief Economist Robert Dietz. “New data on second homes points to most housing construction taking place in areas with fewer second homes, as most second family homes are located in less urban areas such as non-metro counties.”