Single-family Construction Outlook Continues Growth Trend

Despite double-digit losses in overall construction starts, single-family housing is a rare bright spot for the U.S. construction market in 2020 and 2021

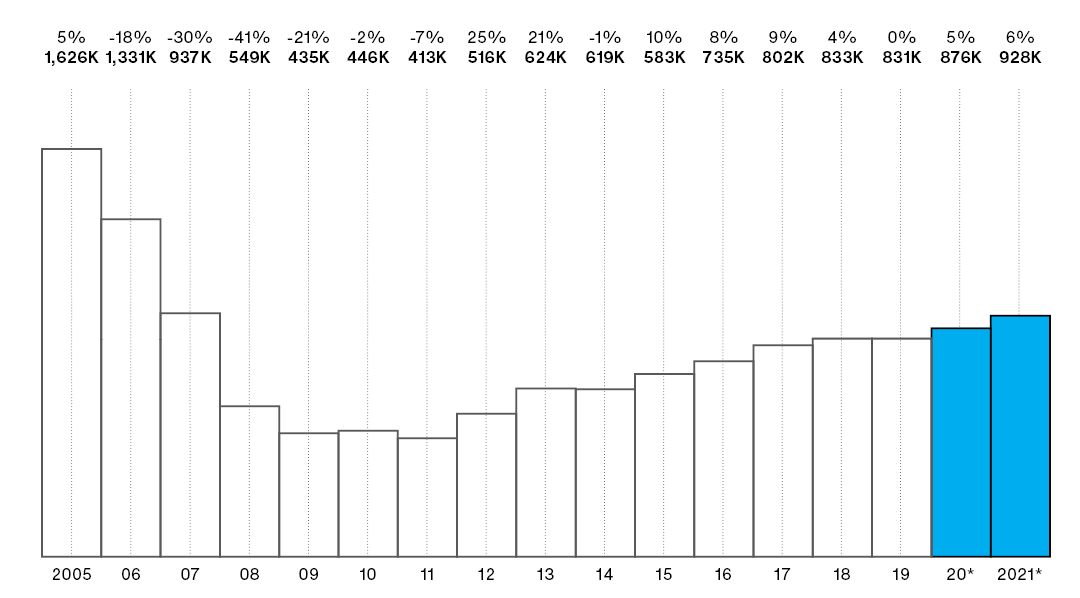

Despite double-digit losses in overall construction starts, single-family housing continues growth trend. Graph shows year-over-year single-family construction growth percentage, 2005-2021. *Projected

While overall construction starts will fall 14 percent to $738 billion in 2020, with a modest recovery of 4 percent projected in 2021, the single-family market is headed for two more years of growth, according to the Dodge Construction Outlook 2021, from Dodge Data & Analytics.

“The single-family market … is one of three verticals we track that is expected to grow in 2020,” said Richard Branch, chief economist for Dodge, during the 2021 Dodge Outlook Conference last November. (The others include warehouse construction, and steel and bridge construction).

Single-family Makes a Comeback

Although the single-family segment experienced a steep decline in the second quarter of 2020 due to more widespread shutdowns and stay-at-home orders, it quickly recovered as the economy opened back up during the summer months. “Over 1 million units broke ground in the third quarter,” Branch says, making it “the best quarter [for single family starts] since 2006.” If the current forecasts are accurate, 2021 would return housing starts to their highest levels since 2007.

Multifamily Contraction Continues

The news is dimmer for multifamily construction, which is projected to see double-digit declines in 2020, with starts falling an estimated 12 percent in 2020 to 496,000 units. Contraction will continue in 2021, with another 2 percent decline to 484,000 units.

The conference yielded several key takeaways about the health of the market, as well as market drivers and barriers to growth.

Quick Stats

7%

projected gains in single-family spending in 2021 to $254 billion

6%

projected increase in volume in 2021 to 928,000 units

3 Market drivers

Low mortgage rates

In response to a cratering U.S. GDP in the second quarter of 2020, the Federal Reserve cut federal funds to nearly zero, bringing mortgage interest rates below 3 percent. “Home sales posted stunning comeback as rates tumbled,” Branch says.

First-time buyers

“The number of first-time buyers is growing substantially—mainly the millennials age group,” says Branch. Just under 40 percent of millennials own homes, and the number has “risen nicely” over the previous year, he says.

Demand for space

In the wake of COVID-19, many buyers are looking for more space. “The pandemic has caused people to rethink their living situation,” Branch says. “Perhaps they are looking for additional space outside of urban areas, especially for people who have the flexibility to work from home.”

3 Barriers to growth

Lumber prices

Lumber prices spiked in 2020. Softwood lumber—structural lumber—was up 81.2 percent year-over-year, as of September 2020, while plywood was up 36.4 percent, according to Branch.

Labor

“We know that there continues to be in the construction sector a stark availability of skilled and available labor, even despite the job losses we saw back in March and April,” Branch says.

Land costs

“Land costs and zoning issues are making it harder to build single-family housing,” Branch says.

Information is based on projections from the Dodge Construction Outlook 2021 from Dodge Data & Analytics. Read the complete forecast in the January/February edition of Window + Door.